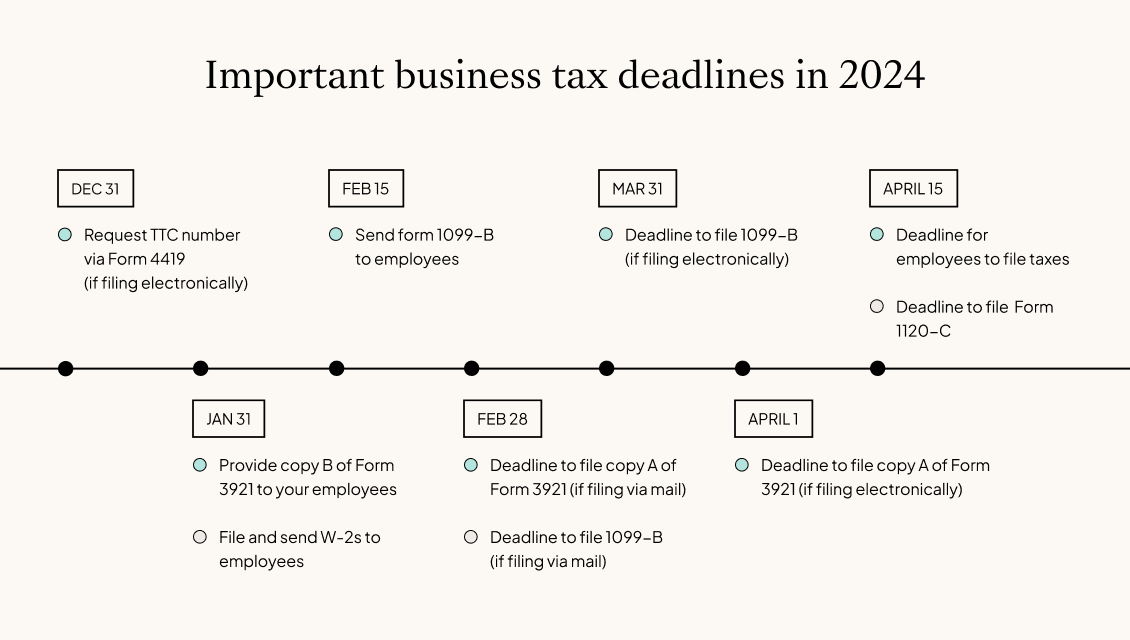

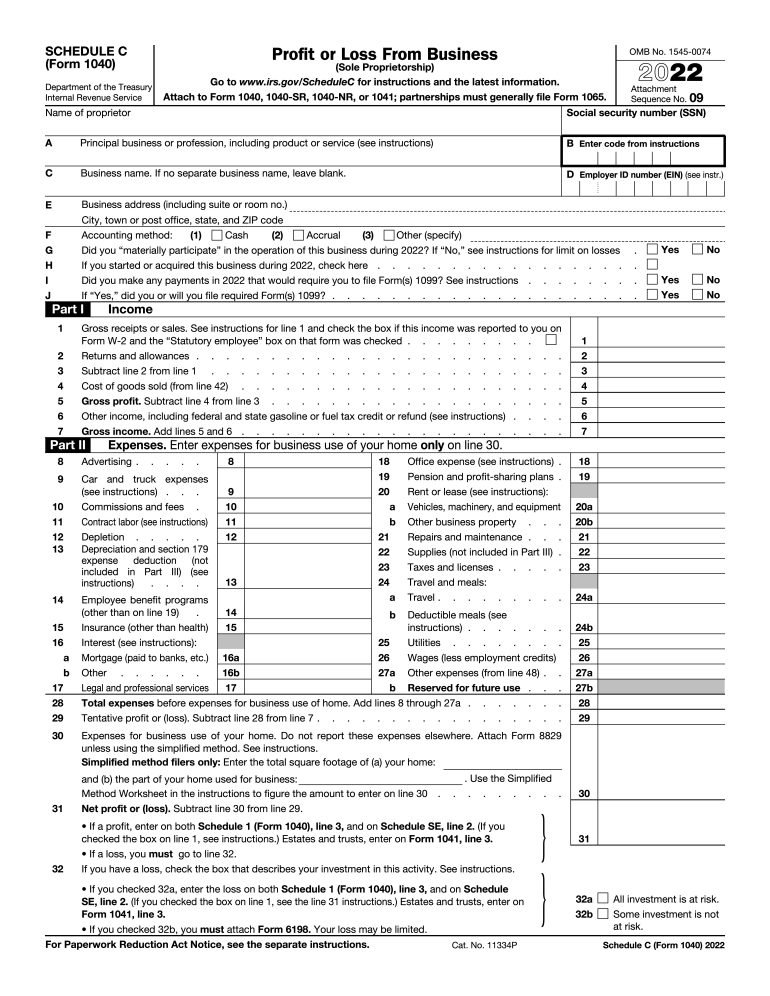

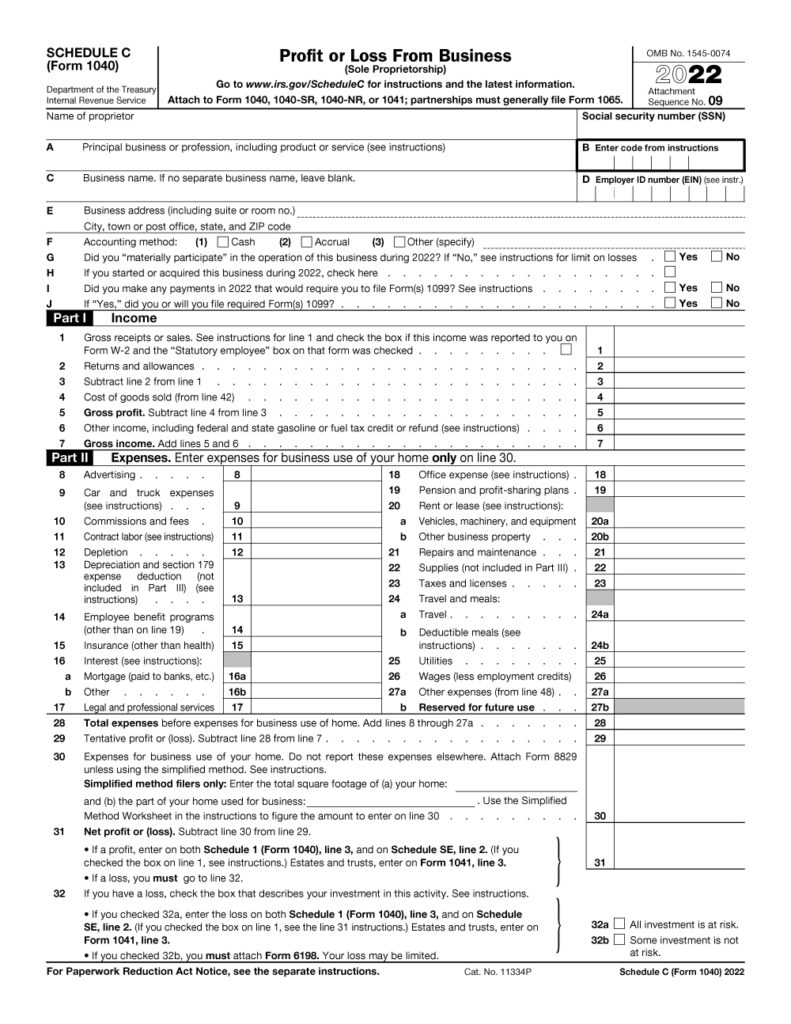

Irs Form 1040 Schedule C 2024 – The due date to file an updated Income Tax Return (ITR-U) for 2021-22 is declared as 31st March 2024. The Income Tax Department of India has tweeted to alert the taxpayers regarding the approaching . The IRS offers two basic You take the deduction on Schedule C if you are self-employed or a sole proprietor, or as an itemized deduction on Form 1040 if you are an employee. .

Irs Form 1040 Schedule C 2024

Source : carta.com

What Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet

Source : www.nerdwallet.com

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

What Is a Schedule C IRS form? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Property Tax Listing – Town of Milton, Buffalo County, Wisconsin

Source : townofmiltonwi.gov

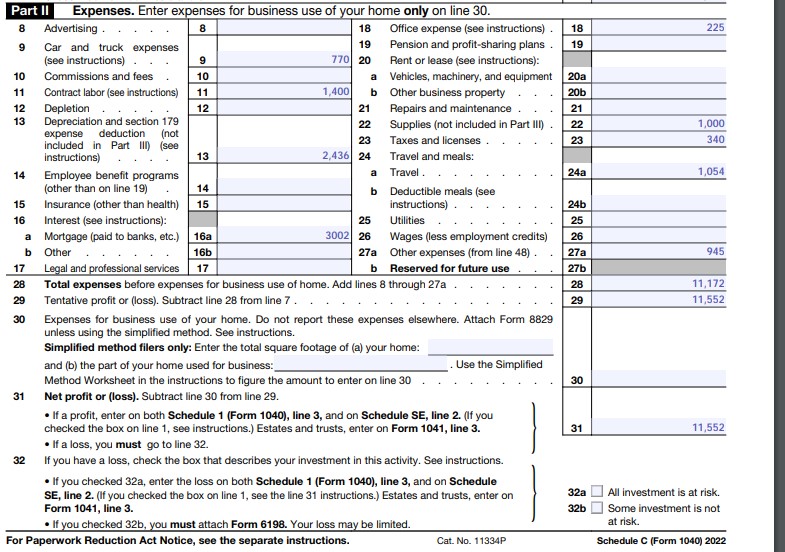

How To Fill Out Your 2022 Schedule C (With Example)

Source : fitsmallbusiness.com

Schedule C (Form 1040) 2023 Instructions

Source : lili.co

Budgets 2 Goals | Baton Rouge LA

Source : www.facebook.com

Cracking the Personal Tax Return Code Part 1: Form 1040, Schedules

Source : financialedinc.com

Tax Forms For 2024 Tax Returns Due in 2025. Tax Calculator

Source : www.efile.com

Irs Form 1040 Schedule C 2024 Business tax deadlines 2024: Corporations and LLCs | Carta: Hi there, I help in providing the Tax forms as details given below. W2 and W3 Schedule C for self employed 1040 Tax Form (2 Pages Only) 1099 Independent Form 940 and 941 Payroll Form Payroll Report . tax form that is used to report income and expenses for a business. Schedule C must accompany Form 1040, which is a taxpayer’s main tax return. Self-employed individuals, sole proprietors of a .